Unlock Growth with Merchant Cash Advances

Cash advances offer a simple way to access funding based on your daily card terminal transactions and online payment platforms, with a flexible repayment structure designed to suit your business.

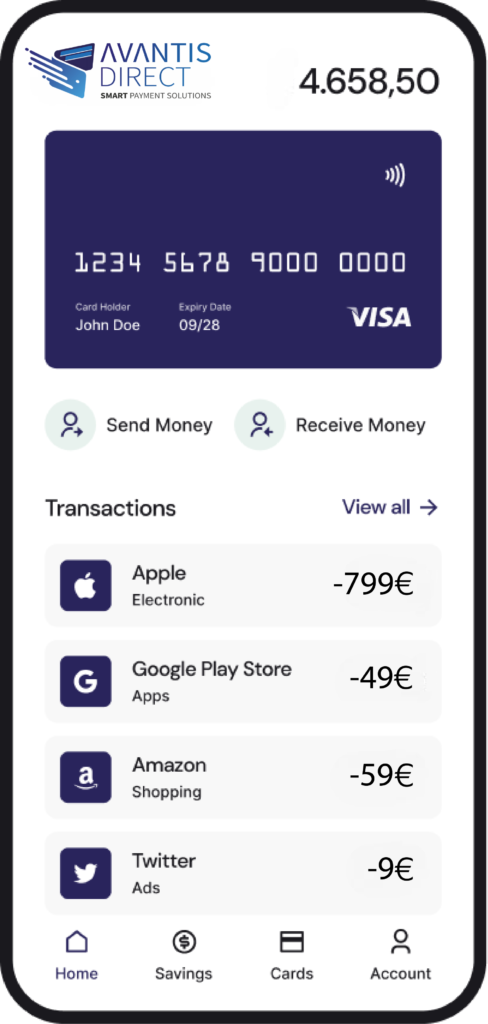

Seamless Payments with Visa,

Mastercard, and Many More!

Merchant Cash Advances, Made Easy

We review your merchant statements and provide a tailored quote for how much you can borrow. Once approved, a small percentage of each card transaction goes toward repaymentno fixed terms, no stress. Renew your facility easily after partial repayment.

How it Works?

Three Simple Steps to Hassle-Free Payments

Sale

Customers pay via card, and funds are deposited into your nominated settlement account or business bank account effortlessly.

Redirection

The acquiring bank updates your settlement account, redirecting payments to merchant account to enable seamless repayment processing.

Repayment

A portion of each transaction is automatically allocated (e.g., 85% to you, 15% to the finance company), ensuring smooth and flexible repayments.

Flexible Repayment

& Payment Solutions.

Maximum Split of 20%

Repay the advance with a maximum of 20% of future sales.

Advance up to 125%

Receive an advance equal to 125% of the client’s average monthly sales.

1 Fixed All-Inclusive Fee

Pay a single fixed fee with no interest or additional APR charges.

Lender Network

We collaborate with multiple lenders for optimal financing options.

Couriers & Drivers

Works with most UK card acquiring banks for smooth payment processing.

No Minimum Repayment

Repay any amount without a required minimum weekly or monthly payment.

Secure £5k to £300k in Business Funding

Trade for 6-12 Months.

Ensure your business has been actively trading for a minimum of 6 to 12 months. This demonstrates stability and eligibility for funding.

Trade for 6-12 Months.

Ensure your business has been actively trading for a minimum of 6 to 12 months. This demonstrates stability and eligibility for funding.

Accept payments via PDQ or online.

Use a card machine (PDQ) or an online Platforms to process customer transactions efficiently.

Trade for 6-12 Months.

Ensure your business has been actively trading for a minimum of 6 to 12 months. This demonstrates stability and eligibility for funding.

Trade for 6-12 Months.

Ensure your business has been actively trading for a minimum of 6 to 12 months. This demonstrates stability and eligibility for funding.

Quick, flexible funding for your business.

90% approval rate

Enjoy a 90% approval rate, making funding accessible to most businesses with ease and efficiency.

Approval within 24 hours

Get your application reviewed and approved within 24 hours, ensuring no delays in securing funds.

Support your business alongside pandemic loans or grants.

Integrate payments effortlessly with secure and developer-friendly options, supporting multiple shopping carts and channels for seamless transactions.

No impact on credit score

Secure funding with zero impact on your credit score, keeping your financial standing intact.

Repay as customers pay you.

Make repayments tied to your sales, ensuring cash flow flexibility and ease of management.

No APRs, interest, fixed payments, or late fees.

Enjoy transparent funding with no APRs, interest rates, fixed payments, or hidden fees involved.

Merchant Cash

Advance vs. Bank Loans

Merchant Cash

Advance

See why Merchant Cash Advance is the smarter choice for SMEs.

-

One, all-inclusive cost.

-

No fixed term.

-

No fixed monthly payments.

-

Approval in 24 hours.

-

Funding within 48 hours.

-

No security required.

-

No business plans.

Costly Bank

Loans

Bank Loans: Slow and costly demanding more than they give.

-

One, all-inclusive cost.

-

Fixed repayment terms.

-

Fixed monthly payments.

-

Approval takes weeks.

-

Funding delays.

-

Collateral required.

-

Business plan always required

Customer Journey Process

We review your merchant statements and provide a tailored quote for how much you can borrow. Once approved, a small percentage of each card transaction goes toward repaymentno fixed terms, no stress. Renew your facility easily after partial repayment.

Application

Please submit your application along with a photo ID and your business bank statement.

Offer in Principle

Automated credit checks undertaken and indicative offer presented.

Underwriting & Offer

Application underwritten and contracts generated

Funding

Receive your funds within one hour of approval for fast access to capital.

Accepting All Major Cards