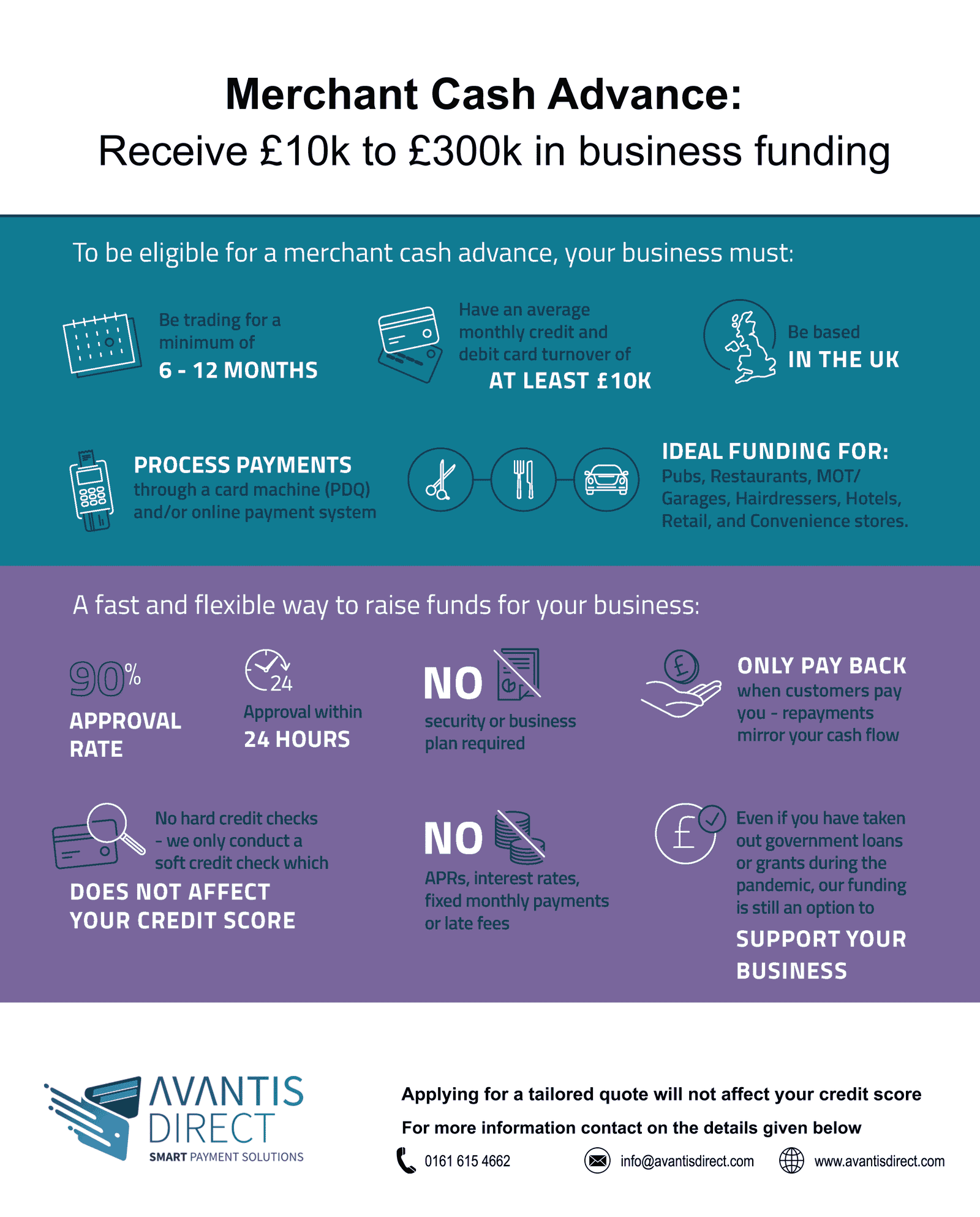

A Merchant Cash Advance (MCA) is a simple cash flow-friendly way to borrow funds against your daily transactions on your card terminal with a flexible repayment method.

Cash Advances

- Home

- Cash Advances

How it Works?

Merchant statements are assessed for affordability. A quote will be provided on how much your customer can borrow.

Once approved a split is setup which enables the finance company to take set % of every card transaction untill the advance is repaid. There is no minimum amount owed or set term (expectations will apply).

Customers can renew their facility once a % of the advance has been repaid.

Customer pays merchant by card payments, funds go into the merchants nominated settlement account / business bank account.

Acquiring bank will change the settlement account that customers has attached to their terminal to a Avantis Direct account to enable a split on the taking to enable repayment. If their is delay we will collect the direct debit in the short term.

Once the settlement account is receiving the funds from the merchant, the hold back amount / split will allow the customer and merchants to receive funds (i.e. 85% Customer / 15% finance company Automatically.

Product Highlights

Advance up to 100% of Client's average monthly taking

Charge 1 all-inclusive fixed fee, no interest or other fee

The advance is repaid as an agreed percentage of their future card sales

Product Highlights

Maximum split of 15%

Work with most UK card acquires

No weekly or monthly minimum repayment amount

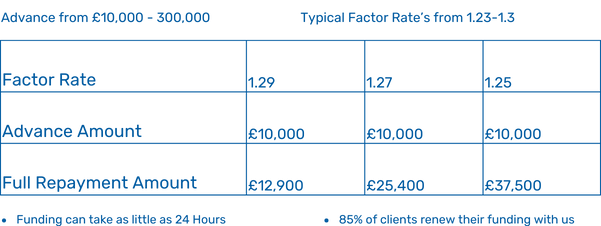

Repayment Examples

Repayment Amounts

Customer Journey

Submit FFF or card statements or 365 portal, landing page or api or Open Banking

Automated credit checks undertaken and indicative offer presented.

Application underwritten and contracts generated

Funding within hour

All Major Cards Accepted