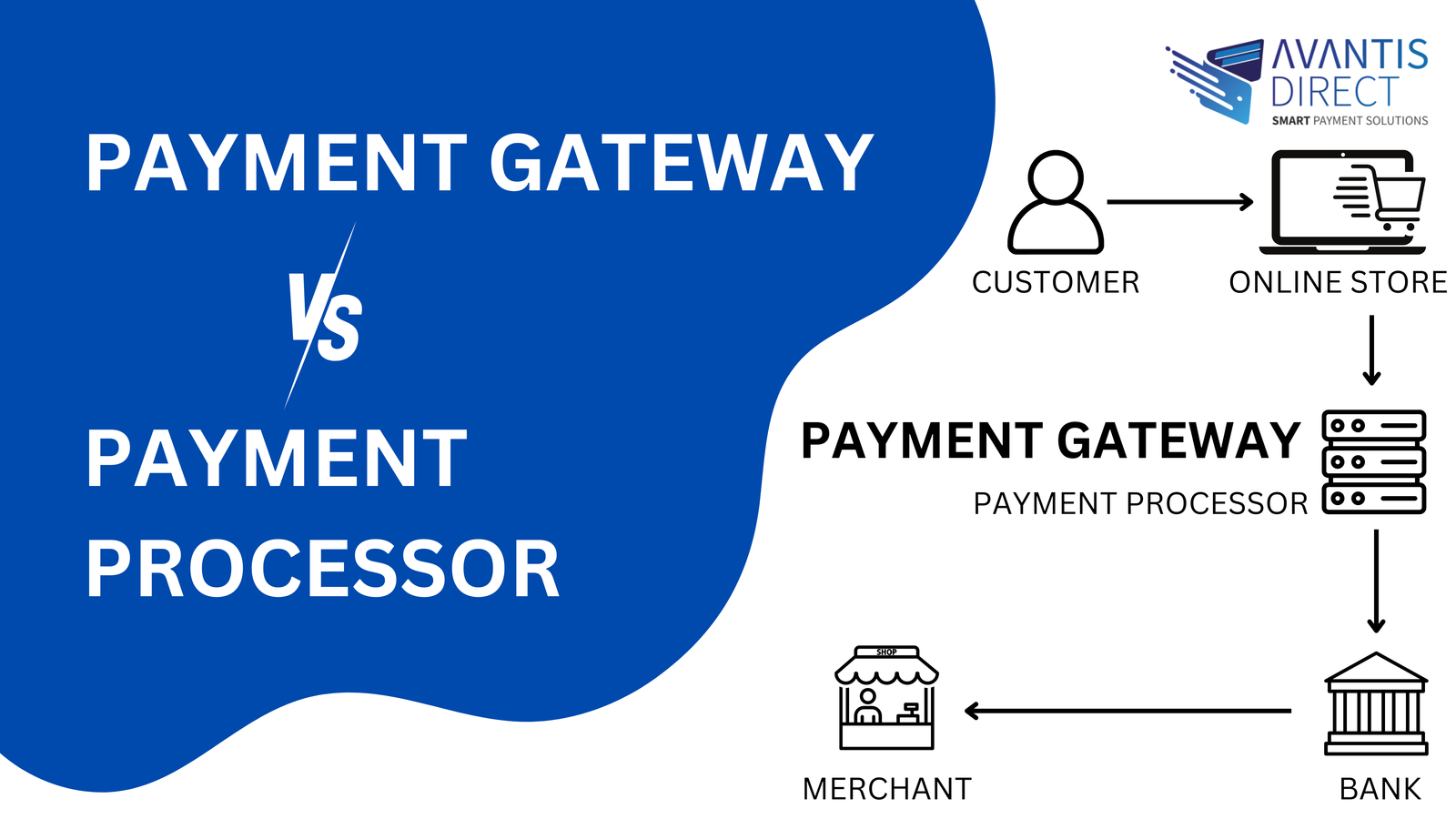

Payment gateway vs payment processor

(Payment gateway vs payment processor) Understanding the difference between a payment gateway and a payment processor is crucial for businesses. Both play essential roles in the transaction process, but they serve different purposes. This guide will explore their definitions, functions, benefits, key differences, and considerations for choosing the right providers.

What is a Payment Gateway? (Payment gateway vs payment processor)

A payment gateway is also an interface for acquiring, processing and transferring payment data of the customer to the acquiring bank. It acts as the online equivalent of a physical point-of-sale terminal in a retail store.

Key Functions of a Payment Gateway:

A payment gateway securely encrypts sensitive information to ensure customer data safety during transmission, sends transaction data to the bank for authorization to verify the validity of card details, communicates the approval or decline of transactions to both the merchant and customer, and integrates with various e-commerce platforms and shopping carts to provide a seamless checkout experience.

Benefits of a Payment Gateway:

- Enhanced security with SSL encryption and tokenization.

- Fast transaction processing and real-time authorization.

- Easy integration with various platforms and payment methods.

- Customer convenience with multiple payment options (credit/debit cards, digital wallets).

What is a Payment Processor?

A payment processor is a service that handles the details of the transaction process between the merchant and the customer’s bank. It facilitates the movement of funds from the customer’s account to the merchant’s account.

Key Functions of a Payment Processor:

- Transaction Routing: Routes the payment information from the merchant to the customer’s bank.

- Settlement: Ensures the funds are transferred from the customer’s account to the merchant’s account.

- Reconciliation: Provides reports and analytics on transaction history, aiding in financial reconciliation.

- Fraud Prevention: Implements fraud detection measures to identify and prevent fraudulent transactions.

Benefits of a Payment Processor:

- Efficient handling of transaction details and fund settlements.

- Reduced risk of fraud with advanced security measures.

- Detailed reporting and analytics for better financial management.

- Support for multiple currencies and payment methods.

Key Differences Between Payment Gateway and Payment Processor

- Primary Function:

- Payment Gateway: Focuses on capturing and securing payment data.

- Payment Processor: Handles the actual movement of funds between accounts.

- Integration:

- Payment Gateway: Integrates with e-commerce platforms and shopping carts.

- Payment Processor: Connects with banks and financial networks.

- Security:

- Payment Gateway: Provides encryption and tokenization for data security.

- Payment Processor: Implements fraud detection and prevention measures.

- Customer Interaction:

- Payment Gateway: Interfaces with the customer during the checkout process.

- Payment Processor: Operates behind the scenes, handling fund transfers.

Choosing the Right Providers

When selecting a payment gateway and payment processor, consider the following factors:

- Security: Ensure the provider meets some of the important measures such as PCI compliance, SSL encryption, and fraud detection.

- Integration: Look for easy integration with your existing e-commerce platform and other business tools.

- Fees: Compare transaction fees, monthly fees, and other costs associated with the services.

- Support: Choose suppliers with clear, efficient customer service, and who can explain the services in detail.

- Scalability: Choose solutions that can scale with your business as it grows.

Conclusion

Understanding the roles of a payment gateway and a payment processor is essential for managing online transactions effectively. While the payment gateway ensures the secure capture and transmission of payment data, the payment processor handles the movement of funds between accounts. By choosing the right providers, businesses can enhance their payment processing capabilities, ensure security, and provide a seamless customer experience. Avantis Direct is also a payment gateway provider, offering comprehensive solutions for your online transaction needs.