What is Payment Integration?

Online payment integration is a process of integrating a payment processor in an electronic commerce website or application. a payment gateway facilitates payments by approving and completing transactions. It passes payment information from the customer to the merchant and eventually to the banking system.

Payment Integration: Simplifying the Transaction Process

In the current digital commerce environment, being capable of handling a large volume of payments in a short time and ensuring their security is one of the keys to success.

Payment integration means adding a payment solution, such as a payment button or checkout page, into a website or an application to facilitate payments from users.

This smooth and efficient transaction also plays and important role in the improvement of the customer experience and the sale and most of all, security.

Why Payment Integration Matters

- Improved Customer Experience: Efficiency in payment also prevents customers from leaving the site halfway through the checkout process hence, increasing customer satisfaction. Some of the ways that affect a large audience include allowing multiple payment methods and easy and efficient checkouts.

- Security: Payment gateways use advanced security measures to protect customer financial details from being compromised. These measures safeguard transactions from hacker attacks and malicious third-party attempts, building trust between the customer and the merchant.

- Operational Efficiency: Payment processing automation cuts down several incidences that require adjustments resulting from errors. This efficiency enables companies to devote their time and energy towards other core matters, for instance, promotion and consumer relations.

How Payment Integration Works

- Choosing a Payment Gateway: Select a reliable provider such as Avantisdirect, PayPal, Stripe, each offering different features and levels of support.

- Setting Up the Gateway: Create an account with the chosen provider and configure the necessary settings, which may include verifying business details and setting up a merchant account.

- Integrating with the Platform: You can integrate payment gateways using APIs, hosted payment pages, or plugins for e-commerce platforms like Shopify, WooCommerce, and Magento. API integration offers the most customization.

- Testing the Integration: Thoroughly test the payment system to ensure all components work seamlessly together.

- Going Live: Launch the payment system and continuously monitor it to maintain security and functionality.

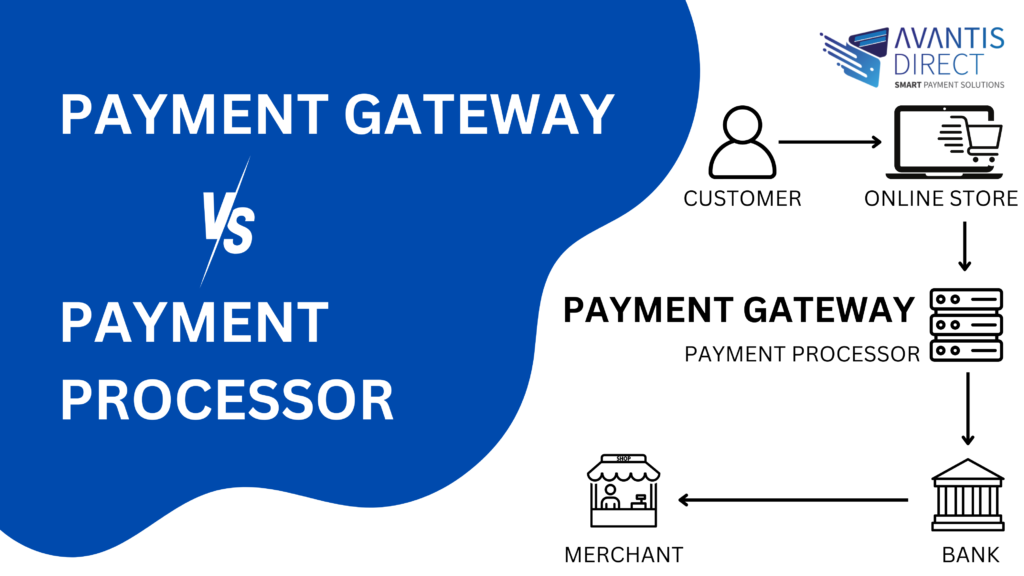

Payment Gateways vs. Payment Processors

People often mention payment gateways and payment processors together, but they serve different roles.

- Payment Gateways: These connect a merchant’s website to a payment processor, focusing on the secure transmission of payment information between customers, merchants, and financial institutions.

- Payment Processors: These handle the technical and financial aspects of processing transactions. They facilitate the flow of information between the customer’s bank and the merchant’s bank, authorize payments, and securely transfer funds.

Types of Payment Gateways

- Redirect Payment Gateways: Customers are redirected to the payment gateway’s platform to complete transactions, reducing the merchant’s security burden.

- On-site Payment Gateways: The payment process is completed directly on the merchant’s website, offering a seamless user experience but requiring higher security compliance.

- Off-site Payment Gateways: A third-party platform handles the payment process on its servers, relieving the merchant of security concerns.

Top Payment Gateway Providers

- Avantisdirect: Avantisdirect provided a complete choice of payment services for companies in order to fulfill their specific requirements, Avantisdirect has become the reliable solution to provide unproblematic transactions and improved customers’ satisfaction.

- Stripe: Known for its easy-to-integrate API and support for various payment methods, Stripe is a popular choice for businesses looking to operate globally.

- PayPal: Widely recognized and trusted, PayPal supports payments through PayPal accounts or credit/debit cards, offering easy integration and secure transactions.

Conclusion

Payment integration is essential for modern businesses, enabling efficient and secure transactions. By understanding the roles of payment gateways and processors and choosing the right type and provider, businesses can enhance their payment systems, improve customer satisfaction, and streamline operations. As digital payments continue to evolve, staying up-to-date with the latest integration technologies will be key to maintaining a competitive edge in the marketplace.